Offline surveys conducted on-premises refer to the practice of collecting survey data in person, without the need for an active internet connection, and typically within a physical location like a retail store, restaurant, event venue, office, or any other physical space.

This approach of using an offline survey app for collecting feedback is commonly used in market research, field research, employee feedback, guest feedback, and collecting customer feedback on the go and at remote locations. It can be installed on iOS and Android smartphones and tablets or on survey kiosks. The best part, they sync feedback automatically and help monitor data in real time.

In this article, we will understand what offline surveys are, real-life scenarios where they are majorly used, the best tools you can use, best practices, and benefits.

TL;DR

- Offline surveys are one of the quickest ways for businesses to collect customer feedback on-premises or in areas with limited or no internet access.

- Instead of going the old way, you can always use an offline survey tool that allows you to collect feedback on a smartphone, tablet, kiosk, and other platforms.

- Offline surveys are extremely useful. They help collect data securely when there is no internet. They are extremely cost-effective and offer detailed feedback reports, just like your online surveys.

- Offline surveys can be used for field research, marketing research, event feedback, and collecting customer feedback through kiosks, tablets, smartphones, etc.

- Apart from that, we have also covered other platforms like Medallia alternatives, Hotjar alternatives, SurveySparrow alternatives, SurveyMonkey alternatives, Qualtrics alternatives, Typeform alternatives, and many more.

- With Zonka Feedback, you can collect offline feedback and let the data sync automatically. It allows you to use survey logic and white labeling to make your surveys more dynamic and customized. Sign up for a free trial of Zonka Feedback or book a demo to get started with this offline survey tool.

Collect & Measure Customer Feedback 📱

With Offline Surveys, understand what users need and learn ways to delight your customers even in remote areas.

What are Offline Surveys?

Offline surveys are a powerful tool for gathering data in areas without reliable internet. They can be conducted using paper-based questionnaires or electronic survey forms on tablets or smartphones. Offline surveys are valuable in various industries, allowing organizations to collect data effectively even in areas with limited internet connectivity.

They are essential for seamless data collection in remote locations or on-the-go surveys. And what's the best way to do so?

Not paper forms, for sure.

The best way to collect data offline in this age is through offline survey software. It is a software or mobile app that allows users to conduct surveys and take feedback without requiring an internet or WiFi connection. They are designed to work offline, meaning that users can collect survey data from respondents without needing an active internet connection and the data automatically syncs later when the internet is available. Offline survey apps usually work on both iOS and Android.

Offline survey platforms are used in various industries for market research, academic research, customer satisfaction surveys, and other types of data collection. They can be a valuable tool for organizations and individuals who need to gather data in areas with limited internet access or to conduct surveys quickly and efficiently.

Real-life Application & Use Cases of Offline Survey Tools

In today's digital age, having a reliable internet connection is crucial for most tasks. However, there are situations where internet connectivity is limited or even nonexistent. This is where an offline survey tool becomes invaluable. Whether you're conducting field research, gathering customer feedback, or performing market research, these tools allow you to collect data and insights even in remote or isolated areas.

Imagine being an anthropologist or a public health researcher working in a remote village with no internet access. An offline survey tool can be a game-changer in such situations, enabling you to gather valuable data and insights without the need for network connectivity. Similarly, market researchers can capture user data at trade shows or shopping malls where internet connectivity may be unreliable.

Some use cases include:

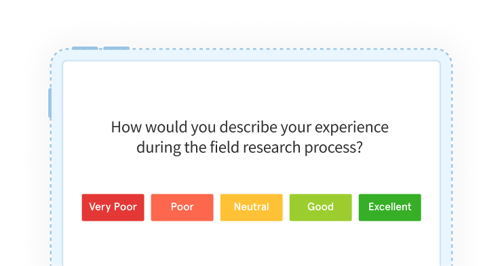

1. Field Research

Offline survey tools are invaluable for researchers engaged in fieldwork, particularly anthropologists and public health researchers who often find themselves working in remote and isolated areas. These survey apps provide a practical and efficient way to gather data and insights even in locations with limited or no internet connectivity so that you can deliver exceptional location based CX.

2. Market research

One can use these apps as their market research tools to capture user data for any type of project. They come with market research survey templates that can be easily used to create surveys to collect in locations where internet connectivity may be limited, such as trade shows or shopping malls.

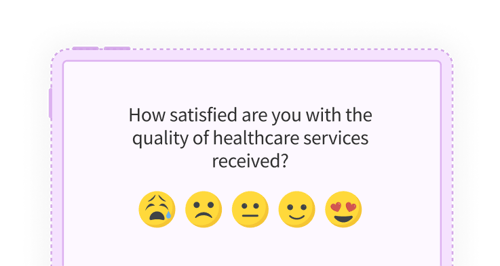

3. Healthcare

Offline survey tools can collect data from patients in remote or underdeveloped areas, which helps healthcare providers improve patient care and treatment. You can include patient satisfaction surveys, health survey questions, mental health surveys, and other types of surveys and questions to gauge complete data about the patient's experience and health information.

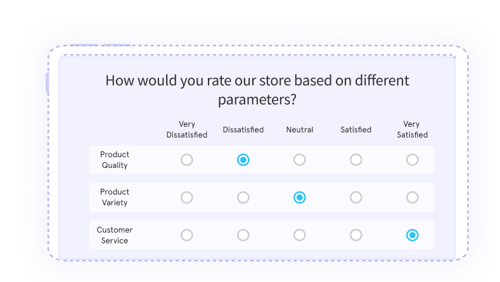

4. Retail

Want to know how shoppers feel about their experience in your store? Equip your retail space with tablets, kiosks, or even smartphones loaded with tailored survey questions. This way, you get real-time insights into customer satisfaction without being dependent on an internet connection.

Identify key touchpoints in the retail space where customers can conveniently engage with surveys, such as near entrances, exits, or popular product sections. Craft concise and relevant retail survey questions that directly address the aspects of the customer experience you want to evaluate. You can also consider providing incentives for customers who participate in surveys, such as discounts, loyalty points, or exclusive offers.

5. Customer feedback

Offline survey tools are used to collect customer feedback, such as in restaurants or retail stores where internet connectivity may be unreliable.

You can take unattended feedback with the kiosk survey app. Placed strategically within establishments, the kiosk survey app allows customers to share their thoughts and experiences seamlessly, without the need for constant internet connectivity. This unattended feedback mechanism not only enhances convenience for customers but also provides businesses with a continuous stream of valuable information to analyze and act upon.

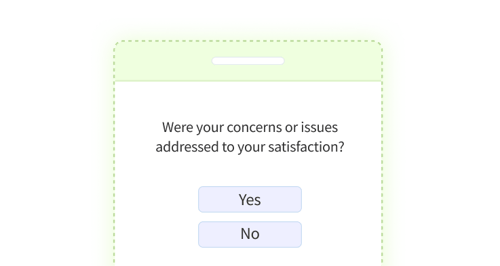

6. Incident Reporting

Offline surveys streamline incident reporting by enabling employees to document incidents in real time, whether on-site or off-site, even in areas with unreliable internet connectivity. These surveys, structured for efficient data collection, allow for the capture of critical details, supporting media, and customization based on organizational needs.

With the capability to synchronize data once connectivity is restored, organizations benefit from efficient recordkeeping, privacy assurance, and prompt notifications for swift response and intervention. This application extends to industries with compliance reporting requirements, ensuring that incident data is seamlessly collected for safety, regulatory, and continuous improvement purposes.

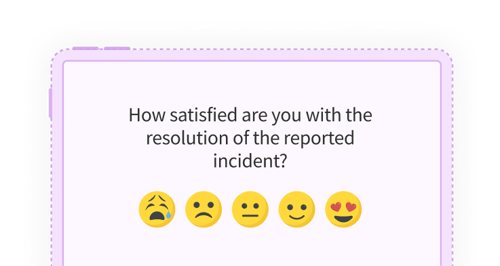

7. Inspection & Audits

7. Inspection & Audits

Replace paper forms for recording data from inspections and audits. Use these tools to collect data from your site inspection and audits in a more organized manner.

Inspection engineers and auditors can utilize tablets or smartphones equipped with offline survey capabilities to document details seamlessly. This transition not only eliminates the hassles associated with paper forms but also enables real-time data collection, enhancing the accuracy and accessibility of inspection and audit records. The shift to offline surveys in inspections and audits contributes to a streamlined and digitized approach, facilitating improved data management and decision-making processes.

8. Non-profit and government agencies

Another real-life example of an offline feedback app is seen in its application in non-profit organizations and government agencies to conduct surveys in rural or underdeveloped areas where internet connectivity may be limited. These surveys transcend the digital divide, allowing these entities to gather valuable feedback and conduct research in regions where online survey tools may not be feasible.

Utilizing offline survey tools, such as mobile devices loaded with survey applications, empowers field workers to collect data seamlessly. This approach facilitates community engagement, aids in needs assessment, and ensures that the voices of individuals in rural or underserved areas are heard. The application of offline surveys in non-profit and government settings exemplifies a commitment to inclusivity, enabling data-driven decision-making even in regions where internet access is constrained.

9. Hotel, Restaurant, and Guest Satisfaction

For the hospitality industry, particularly in hotels and guest satisfaction, offline survey forms prove invaluable. By strategically placing these forms with the right hotel survey questions at various touchpoints within the property, such as check-in desks or common areas, hotels can efficiently capture guest satisfaction feedback.

This approach allows guests to provide their opinions seamlessly, even without continuous internet connectivity. The offline survey method ensures that the hotel gathers real-time insights into the guest experience, covering aspects like room quality, service, and amenities. This not only enhances overall guest satisfaction by addressing concerns promptly but also aids the hotel in making informed decisions for continual improvement based on the collected feedback.

10. Academic research

In the realm of academic research, offline surveys present a valuable tool for collecting data in locations where internet connectivity may be limited or unreliable. Researchers in social sciences, including sociologists, psychologists, and political scientists, can leverage offline survey tools to conduct surveys in diverse settings.

By using tablets or smartphones equipped with offline survey capabilities, researchers can reach respondents in remote areas or communities without consistent internet access. This approach expands the reach of academic research, allowing for a more diverse and inclusive data collection process. Offline surveys in academic research not only overcome connectivity challenges but also provide an efficient means to gather valuable insights and contribute to the robustness and comprehensiveness of social science studies.

11. Event feedback

11. Event feedback

Capturing customer data and information at different events can be tiring, especially when it is in an area that's pretty low on internet connectivity. Whether at conferences, festivals, or other events, offline survey tools enable organizers to capture valuable insights seamlessly.

By strategically placing survey stations or using mobile devices loaded with survey applications, event organizers can gather feedback on various aspects, including speakers, sessions, logistics, and overall attendee experience. This real-time feedback mechanism allows for quick adjustments and improvements, contributing to the success and enhancement of future events. The use of offline surveys ensures a reliable and comprehensive feedback loop, even in settings where continuous internet access may be a challenge.

Let's quickly look at the top 10 offline survey tools and apps.

Offline survey tools have revolutionized data collection processes, enabling businesses and researchers to gather valuable insights from any location, irrespective of internet connectivity. Whether for market research, field surveys, or customer feedback collection, these tools ensure that valuable data is captured and used to make informed decisions, making them essential assets in today's data-driven world. If you are also looking for some of the top Offline survey tools, we have got you covered.

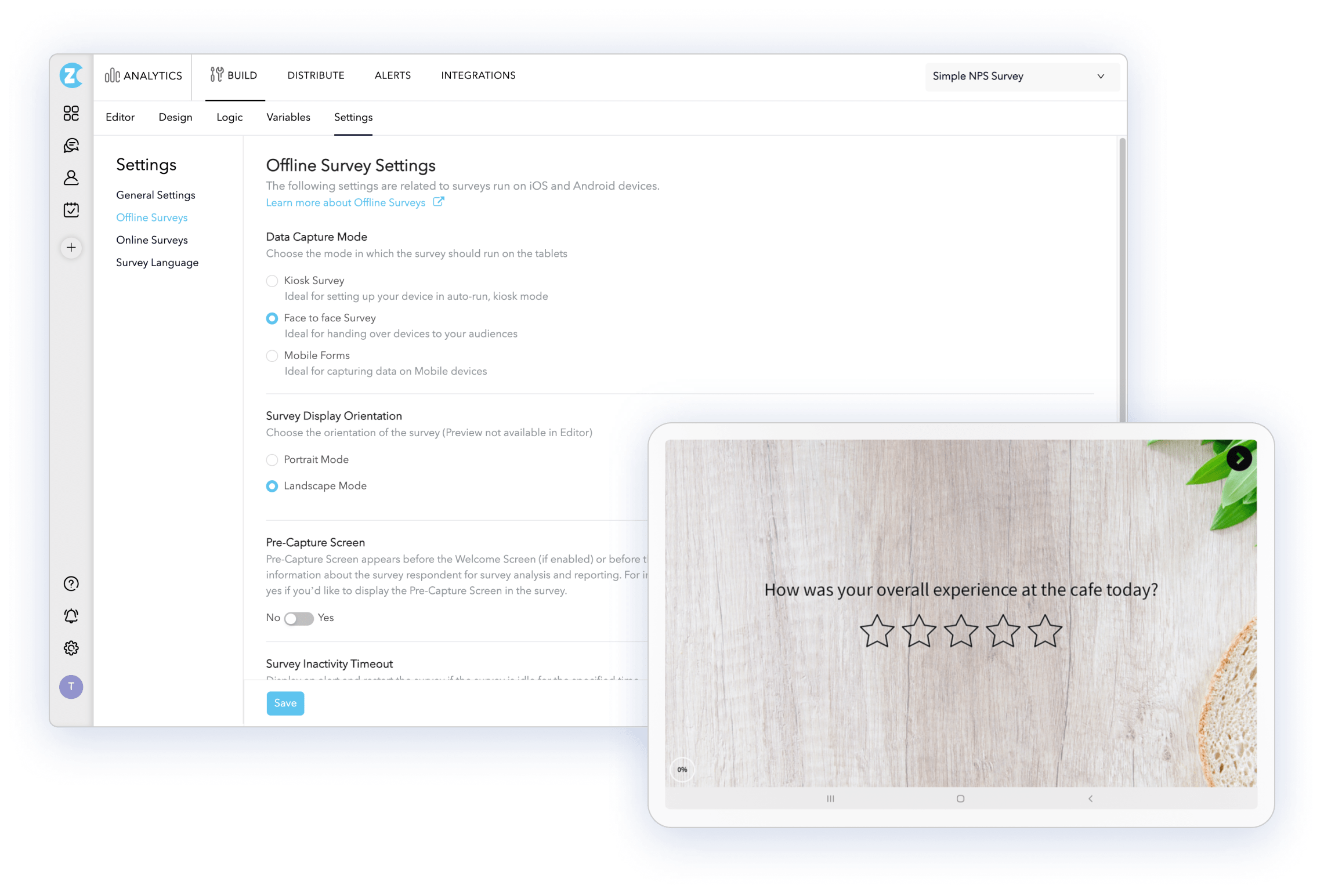

#1. Zonka Feedback Offline Survey App

Zonka Feedback makes it absolutely effortless to take surveys on the go, even in remote locations. With its basic pricing plan starting just at $15 for offline surveys, Zonka Feedback enables users to capture beautiful surveys using iPads, Android Tablets, iPhones, and smartphones.

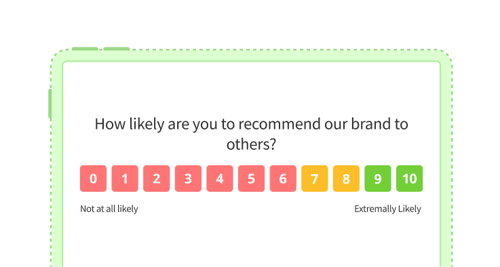

You don’t need any internet or Wi-Fi connection to take customer feedback as the offline survey software from Zonka Feedback helps unattended feedback and syncs it back once connected to the wifi or the internet. Users can even create custom feedback forms to capture customer and employee feedback using different survey types like NPS surveys, CSAT surveys, CES surveys, and more.

Zonka Feedback survey builder is amazing. You just need a few clicks and create surveys either from scratch or choose from 500+ templates. You can even choose any question you want to take or edit the survey design as needed. The multiple languages feature is another cool feature you get with Zonka Feedback, enabling you to capture leads in your local or neighboring areas.

Features of Zonka Feedback's Offline Survey App

Zonka Feedback's offline survey software offers a comprehensive solution for businesses seeking to collect feedback and data in any environment, providing real-time insights, secure data storage, and a user-friendly experience. With this feature, you can ensure that your surveying efforts are not hampered by connectivity issues, enabling you to make informed decisions and improve your overall customer experience.

Here are some features you can get with Zonka Feedback offline surveys.

- Take unattended feedback with the kiosk survey

- Capture data on iPads, Android Tablets, iPhones, Smartphones, and Kiosks mode at any location with or without internet access

- Conduct market research using the offline survey platform

- Survey builder to help create surveys from scratch or use templates

- Choose from 30+ Question Types, add images, logo, edit surveys, etc.

- Make surveys dynamic using skip logic, Hide Logic, Answer Piping

- Collect Data Offline, and sync automatically

- Take feedback from multiple locations, and compare their responses

- Integrate with your CRMs, Customer Support Tools, and Marketing Automation Software with native integrations

Pricing:

Offline surveys platform with Front starts from $15/month

Survey & CX platform with Front starts from $49/ month

Product Feedback platform with Front starts from $39/month

You can also try Zonka Feedback for free for 14 days

G2 Rating: 4.8 out of 5

#2. Qualtrics: Collecting Offline App Responses

Being one of the featured customer feedback tools, using the Qualtrics offline survey tools offers the highest level of data and insights owing to its advanced features. You can download the Qualtrics offline survey tool on your iPhones, iPads, Android Tablets, and phones. The app can then be set up with the required surveys and data collection forms to start collecting responses offline.

This feature-rich app enhances the flexibility and accessibility of surveying efforts, making it a valuable tool for researchers, marketers, and organizations seeking real-time data collection. One can even create and design offline surveys with Qualtrics' survey setting option. Also, incorporating various question types, branching logic, and customization options becomes easy.

Features of Qualtrics Offline App

Opting for Qualtrics surveys provides a strategic advantage in offline data collection efforts. With the capability to gather feedback and insights without relying on internet connectivity, Qualtrics offline surveys ensure uninterrupted engagement with respondents, making them a powerful tool for various scenarios such as remote locations, events, or areas with unreliable internet access.

Here are some features you can get with Qualtrics offline surveys.

- Conduct surveys anywhere, on the go

- Manage respondent experience

- Enable kiosk mode on Android phones & tablets

- Collect geolocation data saved alongside responses

- Integration with the central Qualtrics platform

- Seamless user experience for offline data collection

- Customizable survey designs and branding

- Offline support for both iOS and Android devices

- Enhanced security and data protection measures.

Pricing: You need to get in touch with their sales team.

G2 Rating: 4.4 out of 5

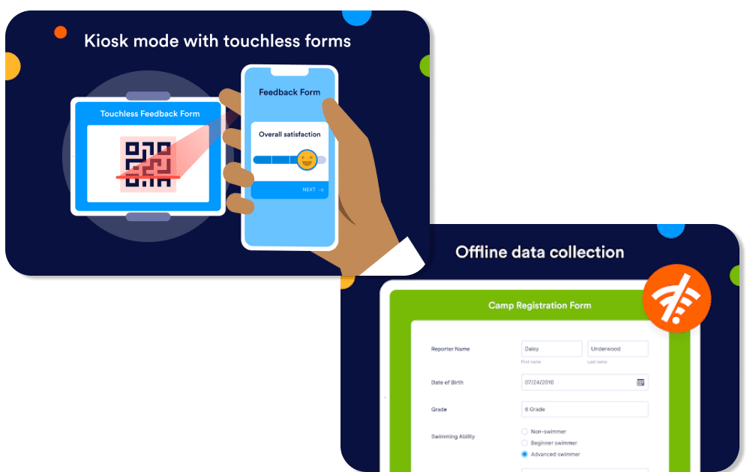

#3. Formstack: Offline Forms Made Easy

Formstack offers a powerful data management solution designed to simplify the way businesses collect and manage information. The platform also provides offline surveys in the form of the Offline Forms add-on, a part of the Formstack Go mobile app. Users can create and manage customizable forms on the go, eliminating the need for paper feedback processes and manual data entry.

Source: Formstack Go

One of the cool features you get with Formstack is its ability to lock a device into a limited kiosk mode, with surveys automatically reloading. It is also reliable to export raw data from submissions and integrate those with tools you use for automated data routing with Formstack mobile app.

Features of Formstack Offline Surveys

Formstack Go offers a comprehensive solution to efficiently collect, manage, and analyze data, enabling you to make informed decisions, enhance user engagement, and drive meaningful outcomes for your organization.

Here are some features you can get with Formstack offline surveys.

- Create and design forms offline, collect data offline

- Sync data automatically when online

- Access and manage form submissions in real-time

- Capture photos and signatures with mobile devices

- Receive instant notifications for new form submissions

- Customize form designs and branding options, share forms with team members or clients

- Integration with the central Formstack platform

- Enhanced security and data encryption measures

Pricing: Can be added to any Formstack plan after consulting the team.

G2 Rating: 4.6 out of 5

#4. Jotform Offline App

JotForm offers a top-tier offline survey application that excels in team collaboration. You can take Jotform mobile forms offline and use them without internet connectivity. You can use the kiosk surveys offered by Jotform in offline mode to get multiple form submissions.

The best part of this offline survey mobile app is that it integrates with Jotform Tables for data analysis, enabling users to easily gather Voice of customer survey responses. And they will automatically upload when you connect online after any event. Thanks to Jotform offline survey, users can also create and edit forms from any location and on any device. With its Kiosk mode, one can even fill out forms or open them without internet access.

Features of Jotform Offline Survey Tool

JotForm's offline survey software empowers users to efficiently collaborate with their team by assigning forms, receiving instant push notifications for responses, and taking immediate actions based on participant feedback.

Here are some features you can get with Jotform offline surveys.

- View and fill out your forms or assigned forms without an internet connection

- Offline submissions are saved to your device and will sync when you connect online

- Use an offline feature on a smartphone or tablet

- Kiosk mode with Screen Lock gives access only to a specific form

- Easily and securely receive multiple form submissions through offline mode

- Forms automatically return to the start page after each submission as data is saved and secured in a separate place

- Make changes in a snap- modify changes as per your needs

Pricing: Starts $34/month

G2 Rating: 4.7 out of 5

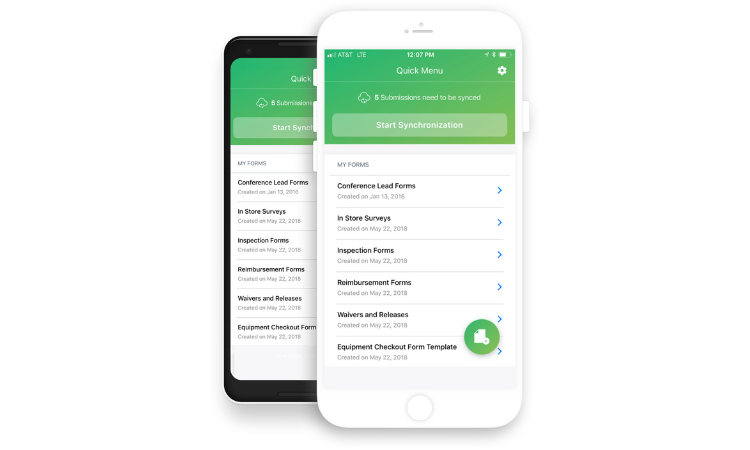

#5. QuickTap Offline Survey App

QuickTapSurvey provides a comprehensive offline survey solution with uninterrupted data collection, allowing businesses to gather feedback, conduct research, and capture valuable information in real-world settings. As one of the top offline survey tools, the platform is supported by Formstack and allows users to capture data anywhere even in offline mode with its beautiful surveys and mobile forms. One can capture leads, customer feedback, or research within minutes at any trade show, event, or in the field.

Whether it's a simple offline poll or in-depth market research, you can create surveys that look awesome and are designed for mobile data capture. Being one of the featured customer feedback tools, QuickTap survey allows you to get automated alerts and notifications based on the data you collect even in the offline mode. The platform also provides Android App to capture data offline via face-to-face surveys, kiosks, or mobile forms.

Features of QuickTapSurvey Offline Surveys

QuickTapSurvey provides a comprehensive offline survey solution that empowers businesses to collect data and insights efficiently, even in areas with limited connectivity. With its user-friendly platform, organizations can easily create and deploy customized surveys that align with their specific needs and objectives.

Here are some of the features you get with the QuickTap survey

- Capture data with beautiful surveys and mobile forms anywhere and in offline mode

- Create and design your perfect survey- choose from the pre-build template

- Collect your data in person or with a kiosk mode

- Use iPads, iPhones, Android tablets, or smartphones to collect data offline

- Use the Android Survey App to capture data offline via a face-to-face survey

- Integrate with partners like Zapier, MailChimp, Salesforce and more

Pricing: QuickTap Survey offers 14 14-day free trial; however, for specific features, you need to get in touch with their sales team.

G2 Rating: 4.7 out of 5

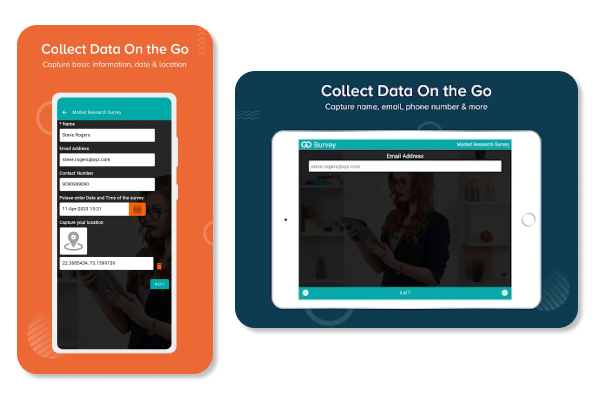

#6. GoSurvey Offline App

The GoSurvey Offline App is an innovative solution offered by GoSurvey, a leading platform for data collection and survey management. Users can conduct surveys without an internet connection on their mobile devices. Whether for market research, field surveys, or trade shows, the offline tool from GoSurvey can seamlessly collect data in the app itself and gets automatically synced to the account whenever the internet is available.

A cool feature that you get with GoSurvey is that you can configure surveys in any language. Also, the customization option is great and allows users to select layouts, colours, backgrounds, and more with ease. One can even collect unlimited surveys on any iOS, Android, or tablet even in the absence of an internet connection.

Features of GoSurvey Offline Survey Tool

The GoSurvey Offline App stands out as a superior choice for data collection due to its unparalleled ability to function seamlessly on the offline survey app. This app is designed to cater to various industries and sectors, offering unparalleled advantages such as remote data collection, real-time analysis, and customizable surveys.

Here are some of the features you get with GoSurvey Offline survey software

- Conduct surveys without an internet connection, collect data in remote or offline locations

- Automatic data syncing when online

- Support for various question types and survey formats

- Real-time access to survey data and insights, also customizable survey designs and branding options

- Offline support for both iOS and Android devices

- User-friendly for all industries

- Multi-language option to conduct offline surveys

- Create subform and share surveys to the targeted audience as a web URL

- Enhanced security and data protection measures

- Collaboration and team management features

Pricing: Starts $12/month

G2 Rating: 4.0 out of 5

#7. SurveySparrow Offline Survey App

SurveySparrow's offline survey software is a great tool, allowing users to collect data without requiring an active internet connection. The offline survey tools help you to gather data anytime, anywhere, at your convenience with a smooth survey-taking experience. Also, automatic syncing ensures no loss of data as well.

This free offline survey software comes with a kiosk mode that lets you fix inactive and restart times for the survey. This way, the form automatically refreshes itself after each session. An interesting feature is, that it also has a dashboard PIN feature that automatically locks the device against unauthorized use when it’s unsupervised.

However, the best part about SurveySparrow is that users can customize everything – from the color palette to the font and branding. The platform also offers the capability to configure survey workflows and boasts an extensive array of integrations, facilitating the collection and analysis of feedback.

Features of SurveySparrow's Offline Survey App

From color palettes to fonts and branding, SurveySparrow offline survey platform can be tailored to align with your vision. Notably, the platform's versatility extends to survey workflows and a multitude of integrations, offering a comprehensive solution for the collection and comprehensive analysis of valuable feedback.

Here are some of the features you get with SurveySparrow

- This app for offline surveys comes with a kiosk mode

- Automatically refreshes itself after each session

- Comes with a dashboard PIN feature that automatically locks the device against unauthorized use

- Customize surveys as per your needs

- Gather data anytime, anywhere, at your convenience

- Create surveys from scratch or choose any template

- Capture & store real-time data

Pricing: Starts from $99/month

G2 Rating: 4.4 out of 5

#8. SurveyMonkey Anywhere

Like its competitors, SurveyMonkey allows users to collect responses even when they’re offline or without an internet connection. Users can collect responses for field surveys at trade shows, conferences, retail stores, or even on the street from any mobile device.

With SurveyMonkey Anywhere, users can download the offline survey software to a smartphone or tablet and take it wherever they need to collect feedback. Its Kiosk mode allows users to turn a mobile device into a survey station. One can even lock down the device and put the survey on auto-pilot mode for a mobile-friendly survey experience.

SurveyMonkey Anywhere?

SurveyMonkey Anywhere offers a host of benefits tailored to your data collection needs. What sets SurveyMonkey Anywhere apart is its versatility – whether conducting field research, remote assessments, or event feedback, this tool adapts seamlessly.

Here are some of the features you get with SurveyMonkey

- Collect data in offline mode anywhere, even from a remote location

- Quickly and securely collect data even when you don’t have an internet

- Use it for field surveys at trade shows, conferences, or retail stores

- Gather in-person evaluations, and collect surveys from the field, retail stores, etc.

- Turn a mobile device into a survey station

- Go from the completed survey to the start page automatically and securely

- Easy device management

Pricing: You need to contact the sales team for the Enterprise plan.

G2 Rating: 4.4 out of 5

#9. SmartSurvey Offline App

SmartSurvey is a leading data collection platform that can quickly and easily create and share online surveys, forms, and questionnaires. With its native analysis tools, one can get the insight that matters to their business. The platform also offers offline survey software that allows users to create an easy-to-use offline survey in a few simple steps. SmartSurvey offline app helps users to engage with the audience and collect survey data without internet access, so they never miss out on gathering the feedback they need.

SmartSurvey’s offline service will store all responses on your mobile device; once you’re connected to the internet. Users can even conduct offline surveys at trade shows, or at the point of experience, in order to collect audience feedback through Kiosk mode. The best part of SmartSurvey is it is even popular among SMS survey tools and users can even text customers the survey link via SMS if they don’t have time to stop and fill in a survey.

Features of SmartSurvey Offline Survey Tool

The SmartSurvey offline app also boasts a user-friendly interface, making survey creation and customization a breeze. With the freedom to design engaging and dynamic surveys, you can capture the precise insights you seek. Additionally, the app's offline capabilities do not compromise on data security – responses are safely stored until a connection is available for synchronization.

Here are some of the features you get with SmartSurvey

- Capture relevant, accurate data in the field, at the point of experience

- Load your offline survey to a smartphone or tablet and take it to any location

- Download responses automatically when a connection is re-established

- Reach a wider audience to help understand users' preferences

- Engage with users and record their opinions through the Kiosk survey

Pricing: Starts $38/month

G2 Rating: 4.6 out of 5

#10. QuestionPro Offline Surveys

The QuestionPro offline survey software enables users to securely conduct market research surveys and collect responses without an internet connection. One can use it for efficient custom feedback and surveys anywhere with any mobile device. It is also easy to create and distribute offline, engaging surveys in minutes with Questionpro's robust platform. However, the number of surveys per device is only limited by the internal and external storage space on the device.

The platform allows users to choose from 80+ supported questions and collect in-depth data in real time. Thanks to its advanced features like branching, piping, and randomization it doesn’t require users to spend time understanding survey logic, and deploy it in the offline mode. QuestionPro also supports local languages, therefore users can customize each offline survey as per their needs. It doesn’t even have any restrictions on the device for the offline survey app as long as it is in the mobile iOS or Android ecosystem. The best part is users can create a survey and deploy it in kiosk mode on any mobile or tablet ecosystem including iPads, iPhones, and Android devices, with robust Android device management capabilities.

Features of QuestionPro Offline Survey App

QuestionPro empowers users to conduct surveys securely, even in the absence of an internet connection. The app's versatility shines through its compatibility with various mobile devices, granting users the flexibility to choose the technology that suits their needs Whether it's market research or comprehensive field surveys, the QuestionPro offline survey software adapts seamlessly to their objectives.

Here are some of the top features you get with QuestionPro offline survey

- Conduct offline surveys anywhere with an advanced offline survey tool

- Conduct market research surveys and collect responses without an internet connection

- Conduct a device audit, customize your UX, sync with Salesforce, set custom alerts

- Create and distribute offline, engaging surveys in minutes

- Build a robust survey with advanced survey logic features

- Conduct offline surveys in any language

- Collect unlimited audio, video, barcodes, images, and other multimedia responses for survey questions

Pricing: Starts at $99/month

G2 Rating: 4.5 out of 5

Advantages of Using Offline Data Collection Tools

Not every business has the connectivity to conduct surveys through different online modes like email surveys, in-product surveys/in-app surveys, SMS surveys, website surveys, and more. Some need to go the extra mile and have the option of conducting offline surveys to capture data even when there is limited or no internet connectivity.

There are several advantages of using offline survey tools:

- No Internet connection required: One of the main advantages of an offline survey app is that they can be used without an active Internet connection. It means that survey administrators can conduct surveys in areas where internet connectivity is limited or non-existent, such as rural or remote locations.

- Data security: Offline survey tools provide enhanced security by storing data locally on the device being used for the survey. This ensures that the data is not transmitted over the internet, minimizing the risk of interception or hacking.

- Better data quality: These tools help to ensure better data quality by eliminating the risk of incomplete surveys or data loss due to poor internet connectivity. With offline data collection software, respondents can complete the entire survey without interruption, resulting in more accurate and complete data.

- Real-time data collection: These tools and apps for offline surveys come with real-time data collection, which can be helpful for researchers or organizations that need to collect and analyze data quickly.

- Cost-effective: Using an offline survey platform can be a cost-effective way to conduct surveys, eliminating the need for expensive internet connections or data plans.

- Customizable: Many offline survey tools offer a range of customization options, including the ability to create custom question types, add multimedia elements such as images or videos, and design the survey to match the branding of the organization conducting the survey.

- Provides Detailed Feedback Reports: Apart from providing you offline support, a good tool also provides the ability to measure different customer feedback metrics (like NPS, CES and CSAT) and gives you detailed feedback reports.

- Getting a Better Response Rate: When you use an offline survey tool, it has a very good effect on the response rate of the survey. When people take surveys and if the survey app gets struck due to bad internet, people tend to leave the survey in between as nobody has much time to spend on surveys. However offline survey software eliminates this problem. It keeps the survey running smoothly even without internet and syncs all the survey data as soon as it gets internet connectivity.

Conclusion

Offline surveys represent a vital bridge between the digital and physical worlds, offering a transformative solution for data collection in various scenarios. By ensuring uninterrupted interactions and data capture, offline surveys enhance response rates, accuracy, and the overall quality of information collected. Some of these top-notch applications, including those like Zonka Feedback, SurveySparrow, and the QuestionPro offline survey app are enabling secure and seamless survey administration in areas with limited or no internet access.

Apart from that, we've also covered the main benefits and use cases of offline surveys in real life. With this information in mind, you can make better use of offline surveys and leverage them to collect feedback more effectively.

You can also sign up with Zonka Feedback to get a 14-day free trial and the countless offline survey templates it has to offer.

MS Teams

MS Teams.webp?width=2000&name=Survey%20App%20(1).webp)