Insurance companies are investing heavily in Voice of the Customer (VoC) programs, yet 71% admit these efforts don’t lead to meaningful business action. The result? Missed opportunities in customer satisfaction, retention, and experience.

Research shows the problem clearly: although 70% of insurance carriers actively collect customer feedback, only one-third believe they’re truly solving problems with it. Even more concerning, just 11% of companies reach advanced VoC maturity. On the flip side, insurers who execute VoC effectively see customer retention increase by up to 55%.

The insurance industry is at a tipping point. By 2025, 90% of insurance customer interactions will take place on digital channels. Customers expect personalized advice, fast and transparent claims processing, and seamless digital communication. Meeting these customer expectations is no longer optional—it’s a direct driver of customer loyalty and revenue growth.

The challenge? While insurance companies excel at gathering data, many fail to connect it to measurable improvements. This gap between data and action has turned VoC into a competitive liability for many insurers.

This guide shows how to close that gap. We’ll combine expert strategies with a step-by-step best practices checklist—covering how to define clear business objectives, map the customer journey, collect feedback across multiple channels, use AI-driven analysis, and close the loop with actionable results. Done right, your voc program in insurance can transform customer experience strategies from theory into a competitive advantage.

TL;DR

-

Most insurance companies collect customer feedback but fail to act on it. A successful voice of the customer program requires:

-

Readiness and leadership buy-in to ensure structure, governance, and accountability.

-

Clear team roles (insight producers and consumers) and integration to break down silos.

-

Journey mapping and multi-channel feedback collection with tools like SMS, in-app, and chatbot surveys.

-

Deeper analysis using customer analytics and natural language processing to uncover themes, sentiment, and escalation risks.

-

Closing the loop by responding quickly to customers and sharing insights across teams with role-based dashboards.

-

Measuring business impact with NPS, CSAT, FCR, churn prediction, and benchmarking.

-

Sustaining momentum through regular review cycles and embedding VoC in everyday operations.

-

-

Leveraging platforms like Zonka Feedback to automate workflows, ensure compliance, and scale programs effectively — schedule a demo today.

Listen, Analyze, and Improve Customer Experience in Insurance

Create surveys, unify all insurance customer voices, analyze using AI, automate with workflows, and improve overall CX.

The Importance of Setting Up a Voice of Customer Program in Insurance

Insurance companies have no shortage of customer data. Every claim, renewal, and service interaction generates valuable insights—but without a structured Voice of Customer (VoC) program, those insights rarely translate into action. The result is a widening gap between customer expectations and the experiences insurers deliver.

Establishing a VoC program closes this gap. It gives insurers a systematic way to capture feedback, analyze it across channels, and embed it into decision-making. More importantly, it ensures that customer perspectives directly shape how products, services, and operations evolve.

The benefits extend across the business:

-

Retention and Loyalty: Acting on customer input reduces churn and strengthens long-term relationships.

-

Operational Improvements: Feedback highlights inefficiencies in claims, renewals, and support that can be corrected.

-

Product Relevance: Insights uncover unmet needs and guide the development of policies and digital tools that customers truly want.

-

Trust and Transparency: Closing the loop demonstrates accountability, building confidence in the brand.

-

Business Growth: Linking feedback to outcomes such as NPS, CSAT, and churn prediction ties customer experience directly to revenue impact.

For insurers, setting up a VoC program is not a reporting exercise—it is a foundation for continuous improvement. When feedback becomes a core input to strategy and execution, insurers gain a lasting advantage in both customer satisfaction and business performance.

Common blockers to success

Even the most well-designed voice of the customer initiatives in the insurance industry face hurdles. Insurers often struggle not because they lack customer feedback, but because structural and organizational barriers prevent them from turning insights into action. The most common blockers include:

-

Feedback silos: Different departments collect customer feedback independently, resulting in fragmented insights. Marketing surveys, claims processing data, and support tickets often tell conflicting stories, making it hard to see the full customer experience.

-

Tool limitations: Many insurance carriers lack advanced VoC platforms or customer analytics tools to capture and analyze customer data effectively. Without these systems, insurers cannot increase customer satisfaction or respond quickly to customer needs.

-

Lack of leadership buy-in: Without executive sponsorship, the voice of the customer becomes just another reporting exercise. Strong leadership ensures that customer expectations and customer pain points shape strategy and decision-making.

-

Channel overload: With multiple digital channels—emails, chatbots, mobile apps, social media, and review sites—teams are flooded with input. This makes prioritization difficult. Insurers must focus on the channels that yield the most actionable insights into the insurance customer experience.

Before Getting Started, Assess Your Insurance Company’s Readiness for a VoC Program

Launching a voice of the customer program requires more than enthusiasm. Insurance companies must first conduct an organizational readiness assessment to confirm they have the culture, processes, and leadership commitment needed to succeed. This evaluation ensures your investment in VoC drives measurable improvements in customer satisfaction, operational efficiency, and long-term customer loyalty.

A comprehensive readiness assessment should include:

-

Project goals and objectives – Define measurable outcomes tied to customer experience and business performance.

-

Leadership support – Ensure executives are aligned and willing to champion customer feedback as a driver of change.

-

Change adaptability – Gauge your organization’s ability to adapt processes around customer needs and pain points.

-

Governance and decision-making – Establish clear structures for accountability and cross-team alignment.

-

Risk mitigation strategies – Anticipate challenges with technology, processes, data security, and compliance requirements.

Timing matters. Conduct this assessment while shaping strategic initiatives, not after resources are committed. Involve employees early—engaging them provides valuable insights into implementation challenges and customer sentiments.

For the insurance industry in particular, readiness also means supporting both insight producers (those who centralize and analyze customer data) and insight consumers (teams who act on insights to enhance customer satisfaction). This dual structure avoids silos, prevents bottlenecks, and ensures insights move seamlessly from analysis to execution.

Skipping this step often results in fragmented feedback, wasted technology spend, and programs that fail to address customer expectations. Once readiness is confirmed, the next step is to see the business through the customer’s eyes—mapping the insurance customer journey to identify where feedback matters most.

Build a VoC Team Structure That Works

Collecting feedback is easy; turning it into action requires the right structure. Too often, insurers assign VoC work to whoever has bandwidth, scatter insights across departments, and wonder why nothing changes. The solution isn’t more people—it’s clearer roles and accountability.

Distinct Roles: Producers and Consumers

Successful programs separate strategic insight production from operational execution.

-

Insight producers align the company around key customer pain points, coordinate readouts, and serve as the central resource for research.

-

Insight consumers use these findings to accelerate development, self-serve insights without bottlenecks, and ground their work in real customer stories.

This division prevents confusion about responsibility and ensures feedback flows smoothly from collection to action.

Breaking Down Silos

Insurance companies often struggle with data silos that fragment the customer journey. Research shows 45% of executives admit their company’s data isn’t integrated, and 37% of businesses lose customers because of it. Integration across claims, service, and digital channels is essential for delivering a positive customer experience and tailoring solutions effectively.

Leadership and Accountability

A dedicated project leader and a focused core team of 5–8 people provide stability and ownership. With executive sponsorship and cross-functional involvement, VoC becomes embedded in roadmaps and decision-making, rather than sidelined as an ad-hoc initiative.

Clear roles, integrated data, and accountable leadership create the foundation for turning customer insights into real business results.

Map the Insurance Customer Journey

Once readiness is confirmed, the first practical step is to see your organization through the eyes of insurance customers. Mapping the customer journey highlights every touchpoint where customers interact with your company and reveals where pain points or missed expectations occur. Without this map, it’s easy to focus on isolated customer feedback instead of systemic issues.

Key Customer Touchpoints in Insurance:

-

Quoting and application through digital platforms or broker channels

-

Policy purchase and onboarding experiences

-

Customer service interactions via call centers, chatbots, or self service options

-

Claims submission, fast claims processing, and resolution

-

Policy renewals and cancellations

💡 Prioritize high-emotion moments—such as claims processing and renewals—because they shape overall customer satisfaction, loyalty, and trust more than routine transactions.

Why this matters: Mapping the customer journey provides actionable insights that guide insurance companies toward smarter investments. For example, if customers report frustration during renewals, the real issue may be unclear pricing communication rather than dissatisfaction with the insurance product itself. By identifying these high-impact moments, insurers can strengthen customer relationships, improve operational efficiency, and deliver a more positive customer experience across multiple channels.

Collect and Analyze Feedback Effectively

Mapping the customer journey shows where insurers should listen, but the real value comes from capturing feedback at those points and analyzing it for meaning. A strong VoC program in insurance does more than collect scores—it brings together multi-channel feedback, qualitative data analysis, and segmentation to uncover patterns that drive action.

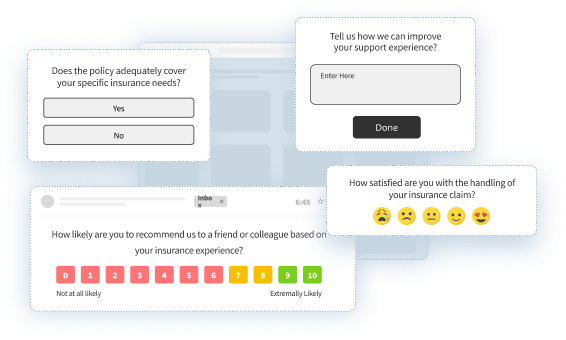

Insurance customers use both digital and traditional touchpoints, so feedback should be captured wherever interactions happen:

-

IVR or SMS surveys after call-center interactions

-

Email surveys following claims or renewals

-

Web and mobile app micro-surveys

-

Chatbot or WhatsApp prompts for quick feedback

-

QR codes at branches or kiosks

Short, contextual surveys increase response rates and help insurers gather feedback in the flow of the customer journey. But capturing feedback is only the first step.

To make this feedback actionable, use an insurance customer feedback software that not only collects responses across multiple touchpoints—like call centers, apps, and claims portals—but also enables you to ask the right questions at the right moment. This ensures the insights gathered are relevant, timely, and reflective of the customer’s actual experience.

While metrics like NPS and CSAT offer a useful starting point to gauge sentiment, they often fall short of explaining why customers feel the way they do. That’s where verbatim comments, social reviews, and call transcripts become invaluable. These unstructured inputs reveal deeper patterns—often hidden beneath surface-level scores.

With customer analytics and natural language processing (NLP), insurers can dig deeper to uncover:

-

Common themes (e.g., slow claim processing, unclear renewal pricing)

-

Sentiment (positive, negative, or neutral)

-

Emotions (trust, frustration, relief)

-

Urgency (issues that need escalation versus low-risk feedback)

These insights show which issues need attention immediately and which reflect broader patterns. Segmenting feedback adds another layer of value. By breaking down responses by policy type, acquisition channel, geography, or claim history, insurers can see differences between auto and life insurance customers and design solutions that meet specific needs.

By combining broad collection, deeper analysis, and smart segmentation, insurers can align improvements with customer expectations, increase satisfaction, and focus operational resources where they matter most.

Close the Loop and Share Insights

Collecting customer feedback is only worthwhile if it leads to visible action. Too often, insurers stop at analysis and fail to resolve issues or communicate improvements, which undermines customer trust. A strong VoC program ensures feedback is acted on promptly and insights are shared widely across the business.

At the customer level, closing the loop means responding quickly and meaningfully:

-

Escalate urgent feedback to claims or support managers

-

Route issues to the right department with clear ownership

-

Track progress through case or ticketing systems

-

Follow up with customers to confirm resolution

Automated alerts and clear accountability prevent feedback from vanishing into silos and show customers their input directly influences outcomes.

At the organizational level, insights must flow to the teams best positioned to act:

-

Executives need high-level trends, loyalty metrics, and business impact

-

Claims managers need data on recurring complaints, delays, and resolution times

-

Customer support teams need clarity on the drivers of inquiries and dissatisfaction

-

Product and digital teams need usability feedback and signals from the customer journey

Role-based dashboards or targeted reports ensure each team gets information they can act on, not just raw data.

By connecting fast resolution for individuals with structured sharing across departments, insurers build a feedback system that improves customer satisfaction, strengthens loyalty, and embeds continuous improvement into daily operations.

Put Your VoC Program to Work in High-Impact Use Cases

Capturing and analyzing customer feedback is only valuable when it's applied in the right areas. For insurers, a Voice of Customer (VoC) program delivers meaningful results when it targets the moments that matter most—like claims, renewals, onboarding, and service interactions. Below are key use cases where implementing a VoC strategy drives real business impact and customer satisfaction.

1. Improve the Claims Experience with Real-Time Feedback

Claims are the most sensitive and emotionally charged part of the insurance journey. A single negative claims experience can impact long-term loyalty. VoC tools help insurers respond faster and more effectively by gathering insights directly from customers post-interaction.

-

Trigger feedback surveys after claim submission and resolution.

-

Use sentiment analysis to detect dissatisfaction or delays.

-

Escalate negative feedback to relevant teams for immediate resolution.

Result: Improved claims turnaround time, reduced escalations, and stronger post-claim customer trust.

2. Increase Policy Renewals with Journey-Based Insights

Policy renewal is a high-risk point for customer churn. Many insurers lose customers due to unclear communication, pricing confusion, or lack of proactive engagement. VoC data helps uncover hidden blockers and address them early.

-

Identify pain points during the renewal process through targeted surveys.

-

Analyze feedback to detect common issues like lack of clarity or delays.

-

Personalize renewal communication to match customer expectations.

Result: Higher renewal conversions and increased customer retention.

3. Enhance Digital Onboarding for New Policyholders

First impressions shape the entire customer relationship. An onboarding process that’s confusing or disjointed often leads to early dissatisfaction. With real-time feedback, insurers can quickly identify where new customers struggle and improve the experience.

-

Collect feedback during web or app-based onboarding flows.

-

Pinpoint friction points such as form confusion, delayed emails, or support gaps.

-

Implement UX changes and content improvements based on insights.

Result: Smoother onboarding experiences and increased satisfaction from the start.

4. Identify Product Gaps and Feature Opportunities

Customers frequently share what they want—if insurers know where to listen. VoC programs help surface unmet needs, product frustrations, or feature requests that can shape future offerings.

-

Analyze call center transcripts, chatbot logs, and open-text feedback.

-

Detect recurring complaints or improvement suggestions.

-

Feed insights into product development and innovation cycles.

Result: A product roadmap guided by real customer input, leading to better adoption and satisfaction.

5. Predict and Prevent Customer Churn

Customer loss is often preventable—but only if insurers can recognize the warning signs. By using VoC to monitor dissatisfaction patterns, companies can intervene before a customer decides to leave.

-

Track negative feedback trends tied to specific products or journeys.

-

Use churn prediction models to identify at-risk policyholders.

-

Launch targeted retention initiatives based on feedback themes.

Result: Lower churn rates and improved lifetime policyholder value.

6. Improve Agent and Frontline Performance

Your frontline teams—agents, support reps, field staff—represent the brand in every customer interaction. VoC tools can help monitor performance and guide coaching based on actual customer input.

-

Request feedback after support calls, branch visits, or digital chats.

-

Analyze sentiment to uncover service quality gaps.

-

Use dashboards to share insights with individual teams or agents.

Result: More consistent service delivery and empowered customer-facing teams.

7. Strengthen Compliance and Risk Management

Customer feedback can help insurers stay ahead of compliance risks. VoC programs enable early detection of issues that could lead to regulatory scrutiny—especially around billing, policy clarity, or data practices.

-

Monitor complaints and feedback for signs of non-compliance.

-

Use AI to flag high-risk comments and recurring regulatory issues.

-

Maintain audit-ready documentation through feedback workflows.

Result: Stronger regulatory compliance and lower operational risk.

Turn Feedback Into Business Results

Customer feedback delivers no value if it remains trapped in dashboards. The difference between successful VoC programs and expensive data collection exercises lies in how insights are translated into measurable outcomes. Insurers that act on customer feedback see reductions in churn, increases in loyalty, and stronger revenue growth.

Measure What Matters

Rather than tracking every possible score, focus on metrics that directly influence business performance. For insurers, this often includes:

-

Net Promoter Score (NPS) to capture overall loyalty

-

Customer Satisfaction (CSAT) to measure specific experiences

-

First Contact Resolution (FCR) to evaluate service efficiency

These are not vanity metrics—they predict customer behavior. Insurers that consistently measure and act on VoC data report a 10% reduction in churn, worth hundreds of thousands of dollars in retained revenue.

Predict and Prevent Churn

Customer loss is one of the most expensive problems in the insurance industry. Predictive analytics and machine learning models can flag customers with a high likelihood of leaving—often with accuracy rates above 90%. By monitoring patterns in engagement, claims activity, or support interactions, insurers can identify customers at 50–75% churn risk within six months. This creates a window to intervene with targeted offers, proactive support, or product adjustments before the customer exits.

Benchmark to Stay Competitive

Even strong internal performance means little without external context. Benchmarking VoC results against industry standards helps insurers understand whether they are keeping pace or falling behind. Useful benchmarks include:

-

Industry averages compared with top-quartile performance

-

Multi-channel resolution times and service costs

-

Multi-year trends in satisfaction, first contact resolution, and response speeds

With clear benchmarks, insurers can prioritize initiatives that deliver the greatest competitive edge rather than chasing incremental improvements that customers won’t notice.

From Feedback to Growth

The lesson is simple: customer feedback is only as valuable as the actions it drives. When metrics are tied to improvement initiatives, predictive analytics are used to retain customers, and benchmarking guides resource allocation, insurers turn feedback into a lever for both customer satisfaction and long-term business performance.

Sustain Your VoC Program

Voice of the customer programs rarely collapse overnight—they fade because organizations stop treating feedback as a living input. Reports pile up, dashboards gather dust, and customer complaints resurface because no system exists to keep insights in motion. The difference between a VoC program that drives results and one that fizzles lies in consistency.

A sustainable program balances short-term responsiveness with long-term learning:

-

Weekly summaries keep urgent issues, such as delays in claims processing, visible to decision-makers.

-

Monthly reviews highlight recurring pain points like renewal communication gaps or paperwork frustrations.

-

Quarterly trend analysis links these insights to larger business decisions and resource allocation.

Equally important is embedding customer feedback into everyday management. Metrics like NPS, CSAT, and churn risk should not sit in isolation but form part of business scorecards. Integration can happen by:

-

Tying feedback themes directly to product roadmaps and claims process improvements

-

Including VoC metrics in performance reviews across teams

-

Using insights to guide digital initiatives and operational efficiency projects

For insurers, sustaining VoC means treating it not as a campaign but as a discipline. When customer insights influence how teams plan, prioritize, and measure success, the program remains relevant—and customers see their voices reflected in every interaction.

Leverage Technology to Scale Your VoC Program

Even the most carefully designed VoC program can stall without the right tools. Many insurance carriers rely on basic surveys or spreadsheets, which limit their ability to capture insights at scale or respond quickly. To sustain momentum, insurers need platforms that automate data collection, integrate with existing systems, and provide real-time analytics.

Key technology enablers include:

-

AI-driven text and sentiment analysis to process large volumes of open-ended customer feedback.

-

Integration with claims, CRM, and digital platforms to centralize customer interactions and eliminate data silos.

-

Automated survey distribution and alerts triggered by events such as claims submissions or renewals.

-

Role-based dashboards that tailor insights for executives, claims managers, customer support, and product teams.

-

Secure, compliant infrastructure with audit trails and risk management features to protect sensitive customer data.

By investing in the right VoC technology stack, insurers move beyond manual reporting to a system that is scalable, efficient, and capable of supporting continuous improvement. Tools don’t replace strategy, but they make it possible to turn feedback into measurable business performance at scale.

Conclusion

Most insurance companies don’t struggle to collect customer feedback—they struggle to use it. Too often, surveys and dashboards produce data without change, leaving customers frustrated and competitors better positioned.

The insurers that succeed with voice of the customer programs treat them not as reporting exercises but as engines for improvement. They establish organizational readiness, secure leadership sponsorship, and design clear team structures. They map the customer journey to identify where feedback matters most, capture insights across multiple channels, analyze both scores and verbatim comments, and close the loop with customers and teams. They track metrics that tie directly to business performance, predict churn before it happens, and benchmark themselves against industry standards. And critically, they sustain momentum by embedding VoC into everyday routines and investing in technology that enables scale.

The message is simple: feedback is only as valuable as the action it drives. With the right structure, tools, and culture, a voc program in insurance can increase customer satisfaction, strengthen customer relationships, and deliver the competitive edge needed in a digital-first market.

Implementing all these steps can feel complex, but with the right technology partner, it becomes much simpler. Zonka Feedback provides insurers with a complete Voice of the Customer platform designed to capture feedback across digital channels, analyze sentiments with AI-driven tools, and deliver role-based dashboards that give every team the insights they need. From reducing data silos to streamlining claims feedback and improving renewals, Zonka helps insurance carriers turn customer input into measurable business results.

With built-in compliance features, real-time alerts, and seamless integrations with CRM and claims systems, Zonka makes it easy to close the feedback loop, enhance customer satisfaction, and scale your VoC program efficiently. Instead of struggling with fragmented tools or manual reporting, insurers can rely on Zonka to drive continuous improvement and customer loyalty.

Ready to transform your VoC program into a growth engine? Schedule a demo with Zonka Feedback today and see how you can turn feedback into action.

.png)

.png)